If you’ve recently checked your bank statement and noticed a charge labeled “BFCB,” you may be wondering what it means. This abbreviation stands for “Bank Fee Chargeback,” and it is a common occurrence for many bank account holders.

In this article, we will dive into what the BFCB charge is, why it appears on your bank statement, and what you can do about it.

Read to know BGC Charge on Your Bank Statement.

Understanding Bank Fee Chargebacks

A bank fee chargeback, or BFCB, is a fee that is charged by your bank when a transaction on your account is disputed and reversed. This can happen for a variety of reasons, such as a fraudulent transaction or a mistake made by the merchant. When a chargeback occurs, the bank will reverse the transaction and credit the amount back to your account. However, they may also charge a fee for this service, which is where the BFCB charge comes into play.

Reasons for BFCB Charges

There are several reasons why a BFCB charge may appear on your bank statement. The most common reason is a disputed transaction. If you notice a charge on your account that you did not make or authorize, you have the right to dispute it with your bank. The bank will then investigate the transaction, and if they find it to be fraudulent or unauthorized, they will reverse it and credit your account. However, they may also charge a fee for this service, which is the BFCB charge.

Another reason for a BFCB charge is if a merchant makes a mistake and charges your account incorrectly. For example, if you were charged twice for the same transaction, you can dispute it with your bank, and they will reverse one of the charges. Again, they may also charge a fee for this service.

How to Avoid BFCB Charges

While BFCB charges may seem like an inconvenience, there are ways to avoid them. The best way is to keep a close eye on your bank account and monitor your transactions regularly. If you notice any suspicious or unauthorized charges, contact your bank immediately to dispute them. It’s also a good idea to review your bank statements regularly to catch any errors or mistakes made by merchants.

Another way to avoid BFCB charges is to be cautious when using your debit or credit card. Only use it at trusted and secure merchants, and never give out your card information to anyone you don’t trust. If you are making an online purchase, make sure the website is secure and reputable before entering your card details.

What to Do If You See a BFCB Charge

If you do see a BFCB charge on your bank statement, don’t panic. The first step is to contact your bank and ask for an explanation of the charge. They should be able to provide you with details about the transaction and why the fee was charged. If you believe the charge is incorrect or unauthorized, you can dispute it with your bank, and they will investigate the matter.

It’s important to note that BFCB charges are not always avoidable, even if you are careful with your transactions. Sometimes, mistakes happen, and fraudulent activity can occur without your knowledge. In these cases, it’s best to work with your bank to resolve the issue and prevent it from happening again in the future.

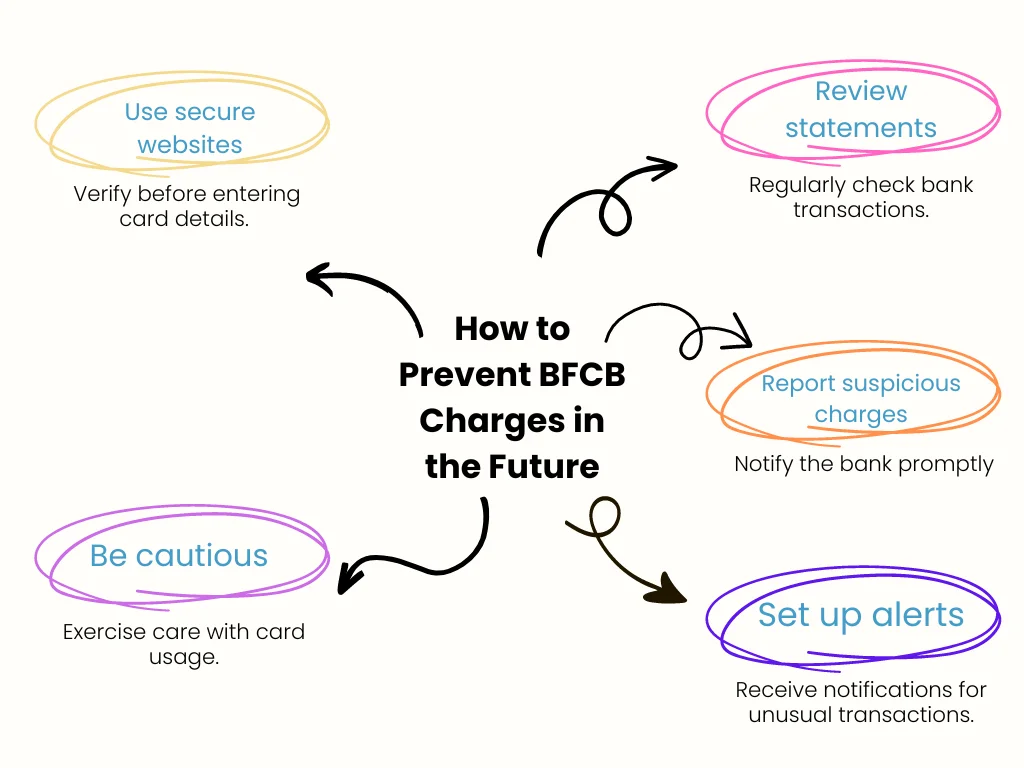

How to Prevent BFCB Charges in the Future

To prevent BFCB charges from appearing on your bank statement in the future, there are a few steps you can take. First, make sure to review your bank statements regularly and report any suspicious or unauthorized charges immediately. You can also set up alerts on your account to notify you of any large or unusual transactions.

Another way to prevent BFCB charges is to be cautious when using your debit or credit card. Avoid using it at unfamiliar or unsecured merchants, and always keep your card information safe. If you are making an online purchase, make sure the website is secure and reputable before entering your card details.

Conclusion

In summary, a BFCB charge on your bank statement stands for “Bank Fee Chargeback” and is a fee that is charged by your bank when a transaction on your account is disputed and reversed. It can happen for a variety of reasons, such as fraudulent activity or merchant errors.

To avoid BFCB charges, it’s important to monitor your bank account regularly, be cautious when using your card, and report any suspicious or unauthorized charges immediately. If you do see a BFCB charge on your statement, contact your bank for an explanation and work with them to resolve the issue. By being vigilant and proactive, you can prevent BFCB charges from appearing on your bank statement in the future.