If you’ve recently checked your bank statement and noticed a charge from “Cardtronics,” you may be wondering what it is and why you were charged. In this article, we’ll dive into the details of Cardtronics and explain what this charge means for you.

Read to know about BillMatrix Charge on Bank Statement.

Understanding Cardtronics

Cardtronics is a global leader in ATM (Automated Teller Machine) services, operating over 285,000 ATMs in various countries around the world. They provide ATM services to financial institutions, retailers, and other organizations, allowing them to offer convenient cash access to their customers.

How Does Cardtronics Work?

Cardtronics partners with financial institutions and retailers to place their ATMs in high-traffic locations such as convenience stores, gas stations, and shopping centers. These ATMs are branded with the logos of the financial institutions they serve, making it easy for customers to identify and use them.

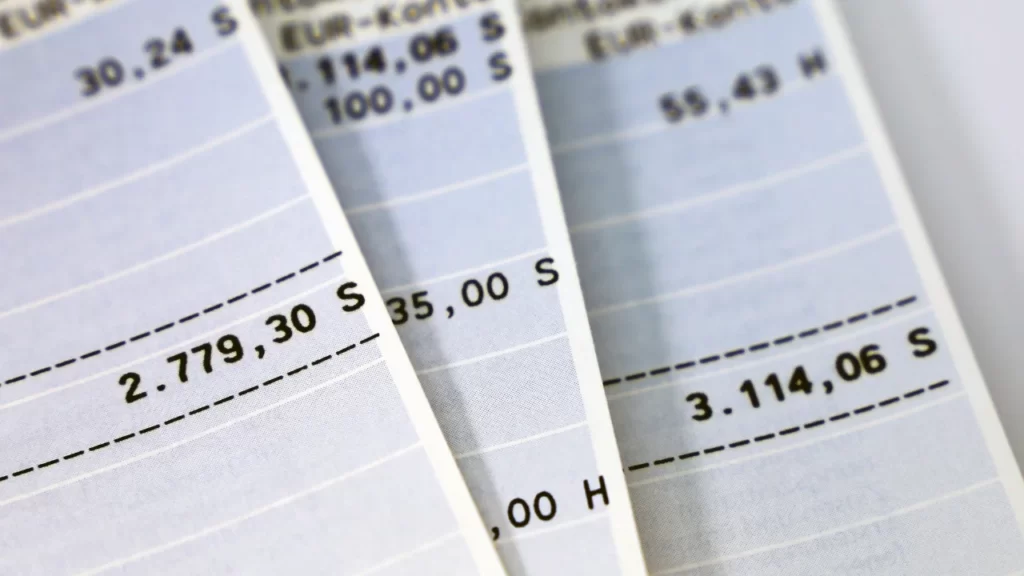

When you use an ATM operated by Cardtronics, you may see a charge on your bank statement with the name “Cardtronics” or “CTRN” next to it. This charge is for the convenience of using an ATM that your bank or financial institution does not own.

Why did Cardtronics charge me?

If you see a charge from Cardtronics on your bank statement, it means that you used an ATM that your bank or financial institution does not own. This could be because you needed cash and the nearest ATM was operated by Cardtronics or because you were traveling and needed access to cash.

Using an ATM that your bank or financial institution does not own may result in additional fees, including a charge from Cardtronics. These fees are typically disclosed on the ATM screen before you complete your transaction, giving you the option to cancel if you do not wish to pay the fees.

How Much Does Cardtronics Charge?

The amount Cardtronics charges you may vary depending on the ATM you use and the fees set by your bank or financial institution. Typically, the fee ranges from $2 to $5 per transaction, but it can be higher in some cases.

It’s important to note that the fee charged by Cardtronics is in addition to any fees charged by your bank or financial institution for using an out-of-network ATM. This means that you may see multiple charges on your bank statement for one ATM transaction.

How to Avoid Cardtronics Charges

If you want to avoid being charged by Cardtronics, the best option is to use an ATM that your bank or financial institution owns. This will ensure that you are not charged any additional fees for using an out-of-network ATM.

Another option is to use your debit card to make purchases instead of withdrawing cash. Many retailers offer cash-back options at the register, allowing you to get cash without having to use an ATM.

If you do need to use an ATM that your bank or financial institution does not own, try to find one that is part of your bank’s network. This may result in lower or no fees for using the ATM.

What to Do If You Were Charged Incorrectly

If you believe that you were charged incorrectly by Cardtronics, you should contact your bank or financial institution immediately. They will be able to investigate the charge and determine if it was a mistake or if there was fraudulent activity on your account.

You can also contact Cardtronics directly through their customer service line or website. They have a dedicated team to handle customer inquiries and concerns.

Conclusion

In conclusion, the Cardtronics charge on your bank statement is for using an ATM that your bank or financial institution does not own. This charge is in addition to any fees set by your bank or financial institution and can be avoided by using in-network ATMs or making purchases with your debit card.

If you have any concerns or questions about a Cardtronics charge, don’t hesitate to reach out to your bank or financial institution for assistance. They will be able to provide you with more information and help resolve any issues.