If you’ve recently checked your bank statement and noticed a charge labeled “CRO,” you may be wondering what it means. CRO stands for “Cardholder-Activated Terminal” and is a fee that your bank charges for using your debit or credit card at certain types of terminals. In this article, we’ll dive into the details of what the CRO charge is, why it’s applied, and how you can avoid it.

Read to know about Chegg Order Charge on Bank Statement.

Understanding the CRO Charge

The CRO charge is a fee that is applied to your bank account when you use your debit or credit card at a cardholder-activated terminal. These terminals are typically found at gas stations, parking garages, and other self-service kiosks. The fee is usually around $0.50 to $1.00 and is applied each time you use your card at one of these terminals.

Why Is the CRO Charge Applied?

Your bank applies the CRO charge as a way to cover the costs associated with processing transactions at cardholder-activated terminals. These terminals require additional security measures and processing steps, which can be more expensive for banks to handle. As a result, they pass on these costs to the consumer in the form of the CRO charge.

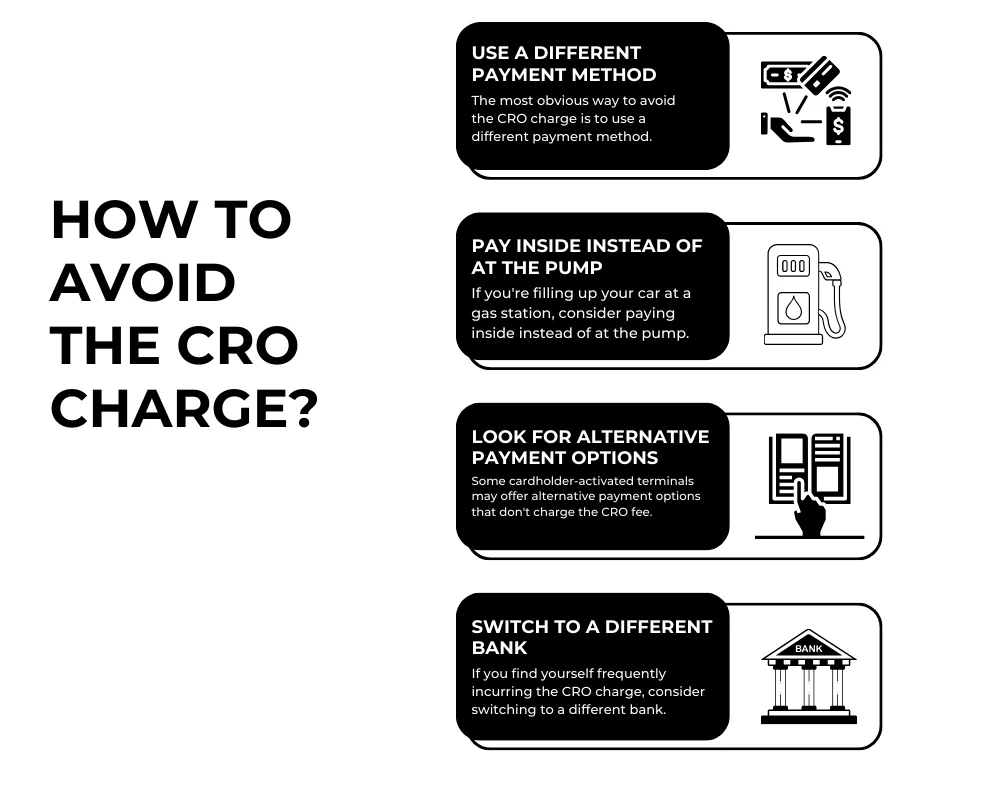

How to Avoid the CRO Charge

While the CRO charge may seem like a small amount, it can add up over time. Fortunately, there are ways to avoid this fee and keep more money in your bank account.

Use a Different Payment Method

The most obvious way to avoid the CRO charge is to use a different payment method. Instead of using your debit or credit card, consider using cash or a different card that doesn’t charge this fee. This may require some planning ahead, but it can save you money in the long run.

Pay Inside Instead of at the Pump

If you’re filling up your car at a gas station, consider paying inside instead of at the pump. Many gas stations charge the CRO fee at the pump but not inside. This may require a little extra time, but it can save you money on each transaction.

Look for Alternative Payment Options

Some cardholder-activated terminals may offer alternative payment options that don’t charge the CRO fee. For example, some parking garages may have a mobile app that allows you to pay without using your card. Be on the lookout for these options and take advantage of them when possible.

Switch to a Different Bank

If you find yourself frequently incurring the CRO charge, consider switching to a different bank. Some banks may not charge this fee or may have lower fees for using cardholder-activated terminals. Do some research and compare different banks to find one that best fits your needs.

How to Identify the CRO Charge on Your Bank Statement

The CRO charge may not always be labeled as such on your bank statement. It may appear as a “cardholder-activated terminal fee” or “debit card fee.” If you’re unsure about a charge on your statement, contact your bank for clarification.

Other Common Bank Fees to Be Aware Of

While the CRO charge may be a new fee for some, there are other common bank fees that you should be aware of. These include:

ATM fees: These are charged when you use an ATM that is not affiliated with your bank.

Overdraft fees: These are charged when you spend more money than you have in your account.

Monthly maintenance fees: Some banks charge a monthly fee for maintaining your account.

Foreign transaction fees: These are charged when you use your card in a different country.

It’s important to read the terms and conditions of your bank account to understand what fees may be applied and how you can avoid them.

Conclusion

The CRO charge is a fee that your bank applies for using your debit or credit card at certain types of terminals. While it may seem like a small amount, it can add up over time. By understanding what the CRO charge is and how to avoid it, you can save money and keep your bank account in good standing. Remember always to read the terms and conditions of your bank account and consider switching to a different bank if you frequently incur this fee.