If you’ve recently checked your bank statement and noticed a charge from Klarna, you may be wondering what it is and why it’s on your statement. In this article, we’ll dive into the details of Klarna charge and explain what this charge means for you.

Read to know LBK or LC Charge on Your Bank Statement.

What is Klarna?

Klarna is a Swedish-based financial technology company that offers payment services for online and in-store purchases. It was founded in 2005 with the goal of making online shopping easier and more convenient for consumers. Today, Klarna is available in over 17 countries and has over 90 million active users.

Why is there a klarna charge on your bank statement?

So, why is there a charge from Klarna on your bank statement? The most likely reason is that you have used Klarna’s “Buy Now, Pay Later” service for a recent purchase. This service allows you to make a purchase and pay for it in installments over time rather than paying the full amount upfront. It’s a popular option for those who may not have the funds to make a large purchase all at once.

When you use Klarna’s “Buy Now, Pay Later” service, you will see a charge from Klarna on your bank statement for the first installment. The remaining installments will be charged to your account on a set schedule, usually every two weeks. This allows you to spread out the cost of your purchase over time, making it more manageable for your budget.

It’s important to note that Klarna does not charge any interest or fees for using their “Buy Now, Pay Later” service. However, if you miss a payment or are late with a payment, you may be subject to late fees and interest charges from the retailer you made the purchase. It’s always best to make your payments on time to avoid any additional charges.

Another reason you may see a charge from Klarna on your bank statement is if you have used their “Pay in 4” service. This service allows you to split your purchase into four equal payments, with the first payment due at the time of purchase and the remaining three payments due every two weeks. Similar to the “Buy Now, Pay Later” service, there are no interest or fees associated with using “Pay in 4.”

How does Klarna work, and what benefits does it offer?

Now that you know what the Klarna charge on your bank statement means, let’s take a closer look at how Klarna works and the benefits it offers.

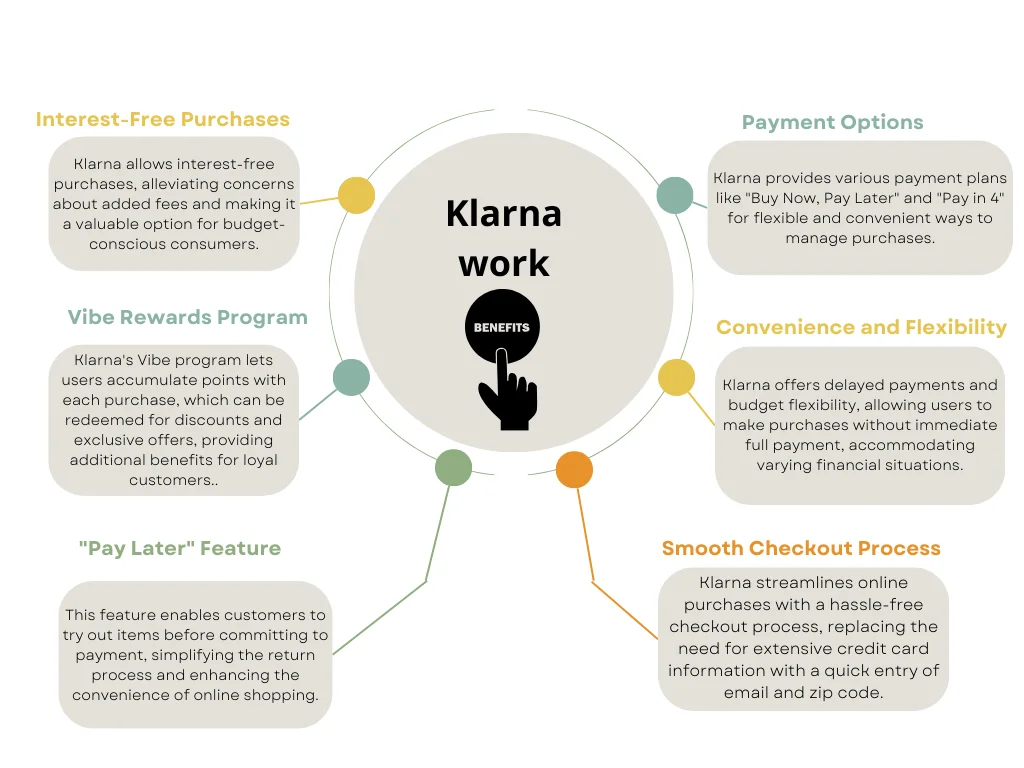

Klarna offers a variety of payment options for consumers, including “Buy Now, Pay Later,” “Pay in 4,” and “Slice It.” The “Slice It” option allows you to finance your purchase over a longer period, with interest rates varying depending on the retailer and your credit score. This option is best for larger purchases that you may not be able to pay off in a few installments.

One of the main benefits of using Klarna is the convenience it offers. With their services, you can make a purchase and pay for it later without having to worry about interest or fees. This is especially helpful for those who may be on a tight budget or have unexpected expenses come up. It allows you to purchase without having to pay the full amount upfront, giving you more flexibility with your finances.

Klarna also offers a smooth and seamless checkout process for online purchases. Instead of having to enter your credit card information and billing address, you can select Klarna as your payment method and enter your email address and zip code. This makes the checkout process faster and more convenient, especially for those who frequently shop online.

In addition to their payment services, Klarna also offers a feature called “Pay Later.” This allows you to try out items before paying for them. You can order multiple sizes or colors of an item and only pay for the ones you decide to keep. This eliminates the hassle of returning items and waiting for a refund, making the online shopping experience even more convenient.

Klarna also offers a rewards program called “Vibe.” This program allows you to earn points for every purchase made with Klarna, which can then be redeemed for discounts and exclusive offers. It’s a great way to save money on future purchases and make the most out of using Klarna’s services.

Common Questions and Concerns About Klarna

Now that you understand what the Klarna charge on your bank statement means and the benefits of using Klarna, let’s address some common questions and concerns.

One concern that many people have is the security of using Klarna. It’s important to note that Klarna is a secure and trusted payment service. They use encryption and other security measures to protect your personal and financial information. Additionally, Klarna does not share your information with third parties without your consent.

Another question that may come to mind is whether or not using Klarna will affect your credit score. The answer is no, as Klarna does not perform a credit check when you use their services. However, if you choose to use their “Slice It” option, the retailer may perform a credit check, which could potentially affect your credit score.

Conclusion

In conclusion, the Klarna charge on your bank statement is most likely from using their “Buy Now, Pay Later” or “Pay in 4” services for a recent purchase. Klarna offers a convenient and flexible way to make purchases and pay for them over time without any interest or fees. With their seamless checkout process and rewards program, it’s no wonder why Klarna has become a popular payment option for many consumers.