If you’ve ever looked at your bank statement and noticed a charge labeled “LH Trading,” you may be wondering what it is and why you were charged for it. In this article, we’ll dive into the details of the LH Trading charge and explain what it is, why it appears on your bank statement, and how you can avoid it in the future.

First, let’s start with the basics. LH Trading is short for “London House Trading,” which is a company that specializes in foreign exchange trading. They offer services such as currency exchange, international money transfers, and foreign currency investments. So, if you’ve recently made a transaction involving foreign currency, it’s likely that the LH Trading charge is related to that.

Read to know ScoresMatter Charge on Your Bank Statement.

Why does LH Trading appear on your bank statement?

Now, why does LH Trading appear on your bank statement instead of the name of the company you made the transaction with? This is because LH Trading acts as a middleman between your bank and the foreign currency exchange. When you make a transaction involving foreign currency, your bank will typically use a third-party company like LH Trading to handle the exchange. This is done to ensure that the transaction is completed accurately and securely.

Why does LH Trading charge a fee for their services?

So, why does LH Trading charge a fee for their services? Well, like any business, they need to make a profit. The fee they charge is their way of making money for facilitating the foreign currency exchange. This fee can vary depending on the amount of the transaction and the currency being exchanged. It’s important to note that this fee is not set by your bank, but rather by LH Trading themselves.

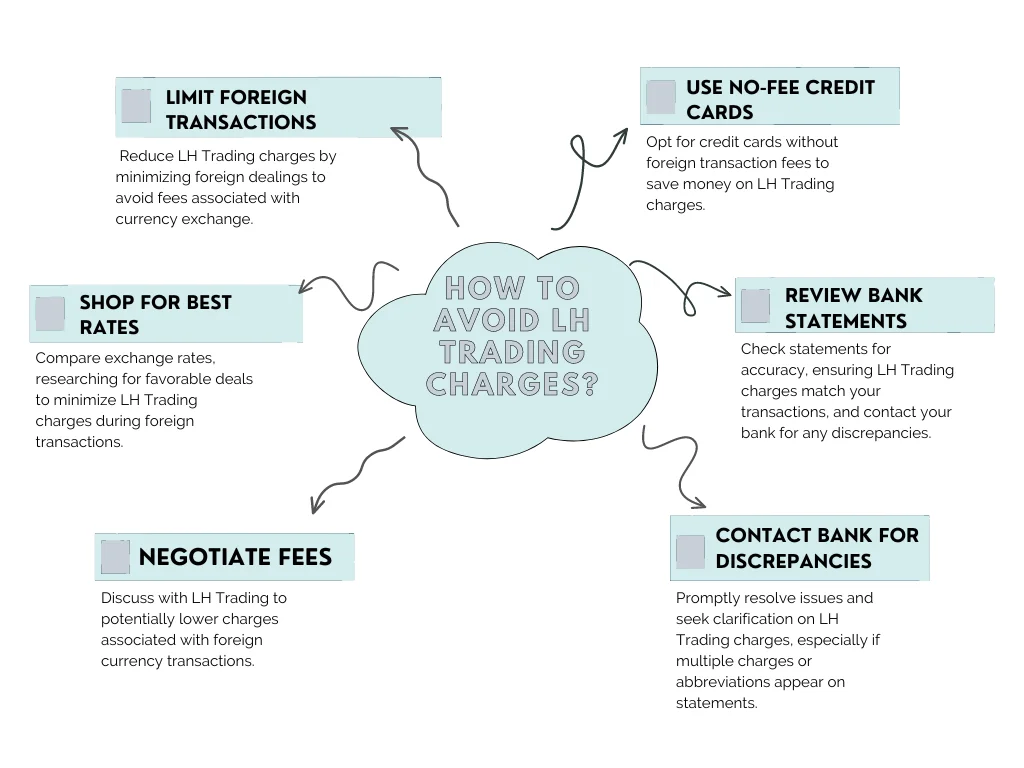

How to avoid LH Trading charges?

Now that we understand what LH Trading is and why it appears on our bank statements let’s talk about how we can avoid this charge in the future. The most obvious way to avoid this charge is to avoid making transactions involving foreign currency. However, this may not always be possible, especially if you frequently travel or do business internationally.

If you do need to make a transaction involving foreign currency, there are a few things you can do to minimize the LH Trading charge. First, you can shop around for the best exchange rates. Different companies may offer different rates, so it’s worth doing some research to find the best deal. Additionally, you can negotiate the fee with LH Trading. While they may not be able to lower the fee significantly, it’s worth a try to save some money.

Another way to avoid the LH Trading charge is to use a credit card that offers no foreign transaction fees. Many credit card companies offer this perk, which means you won’t be charged any additional fees for using your card in a foreign country or making a transaction involving foreign currency. This can save you a significant amount of money in the long run.

If you do find yourself being charged for LH Trading services, it’s important to review your bank statement carefully. Make sure that the amount charged is accurate and matches the transaction you made. If you notice any discrepancies, contact your bank immediately to resolve the issue.

In some cases, you may see multiple LH Trading charges on your bank statement. This could be due to multiple transactions involving foreign currency or multiple exchanges within one transaction. Again, it’s important to review your statement carefully and contact your bank if you have any concerns.

It’s also worth noting that LH Trading charges may appear differently on your bank statement. Some banks may use different abbreviations or list the charge as “foreign transaction fee.” If you’re unsure about a charge on your statement, don’t hesitate to contact your bank for clarification.

Conclusion

In conclusion, the LH Trading charge on your bank statement is related to foreign currency transactions and is a fee charged by the company that facilitates the exchange. While it may be unavoidable in some cases, there are ways to minimize or avoid this charge. By being aware of this fee and taking steps to reduce it, you can save yourself some money and have a better understanding of your bank statement.