Bank statements are an essential part of managing your finances. They provide a detailed record of all the transactions that have taken place in your bank account over a specific period. These statements are usually issued monthly, and they contain information such as deposits, withdrawals, and any fees or charges incurred.

While most of the information on a bank statement is self-explanatory, there may be some codes or abbreviations that can be confusing. One such code that you may come across on your bank statement is NWEDI. In this article, we will delve into what NWEDI means and how it affects your bank statement.

Read to know VIOC Charge on Your Bank Statement.

Decoding NWEDI

NWEDI is an abbreviation for “Non-Workday Electronic Deposit Item.” It is a code used by banks to indicate that a deposit has been made into your account on a non-working day. This could be a weekend or a public holiday when banks are closed.

For example, if you receive a direct deposit from your employer on a Saturday, the transaction will be recorded as NWEDI on your bank statement. This code is used to differentiate between deposits made on working days and those made on non-working days.

Why Does NWEDI Appear on My Bank Statement?

As mentioned earlier, NWEDI appears on your bank statement when a deposit is made into your account on a non-working day. This could be a direct deposit from your employer, a tax refund, or any other electronic deposit.

In the past, banks used to hold deposits made on non-working days until the next working day before processing them. This meant that if you received a deposit on a Saturday, you would not have access to the funds until Monday. However, with the advancement of technology, most banks now process deposits made on non-working days immediately, and the funds are available for use right away.

How Does NWEDI Affect My Bank Statement?

NWEDI does not have any significant impact on your bank statement. It is simply a code used by banks to indicate that a deposit was made on a non-working day. The amount deposited will still be reflected in your account balance, and you will have access to the funds immediately.

However, it is essential to note that if you receive a deposit on a non-working day, it may take longer for the transaction to appear on your bank statement. This is because banks typically generate statements on working days, so any transactions made on non-working days may not be reflected until the next statement is generated.

How to Read Your Bank Statement

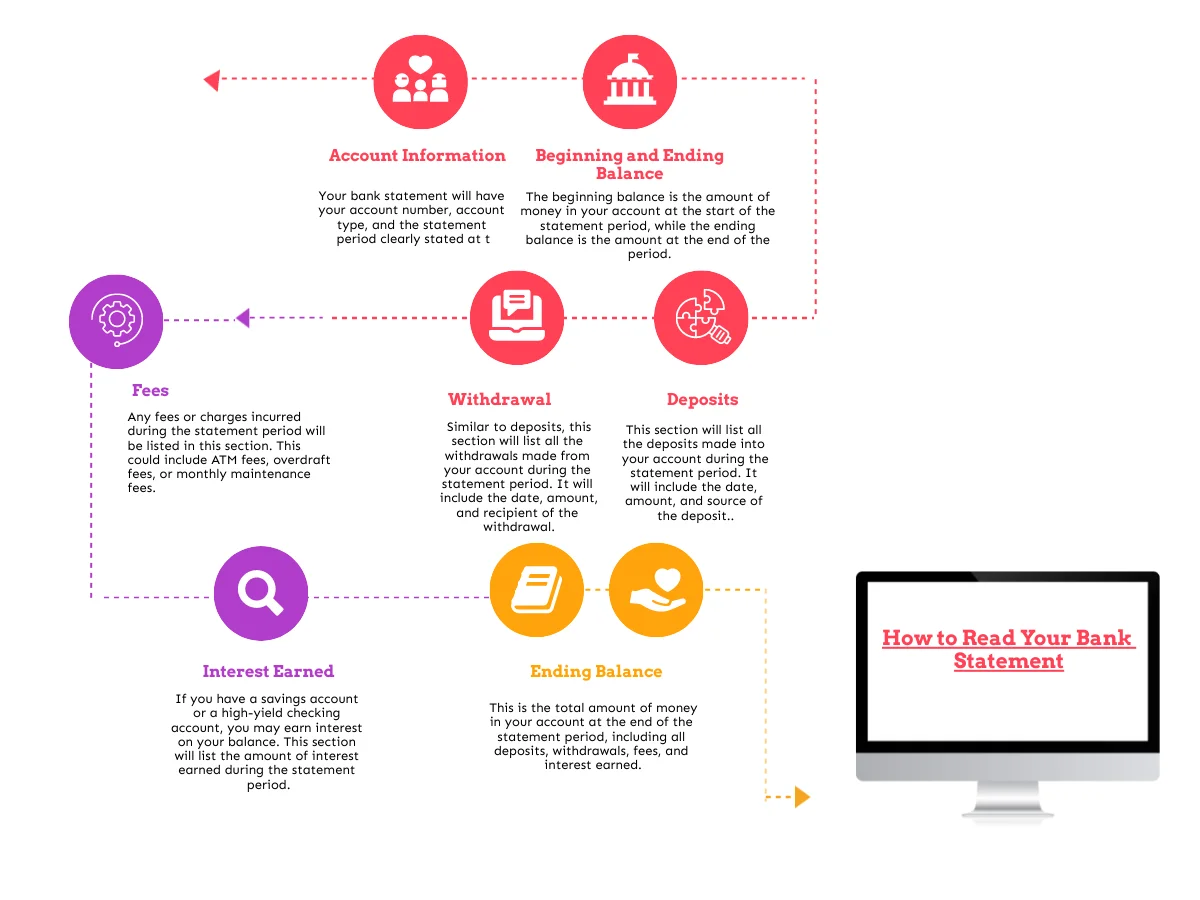

Now that we have covered what NWEDI means, let’s take a closer look at how to read your bank statement. Here are some key elements to pay attention to:

Account Information: Your bank statement will have your account number, account type, and the statement period clearly stated at the top.

Beginning and Ending Balance: The beginning balance is the amount of money in your account at the start of the statement period, while the ending balance is the amount at the end of the period.

Deposits: This section will list all the deposits made into your account during the statement period. It will include the date, amount, and source of the deposit.

Withdrawals: Similar to deposits, this section will list all the withdrawals made from your account during the statement period. It will include the date, amount, and recipient of the withdrawal.

Fees: Any fees or charges incurred during the statement period will be listed in this section. This could include ATM fees, overdraft fees, or monthly maintenance fees.

Interest Earned: If you have a savings account or a high-yield checking account, you may earn interest on your balance. This section will list the amount of interest earned during the statement period.

Ending Balance: This is the total amount of money in your account at the end of the statement period, including all deposits, withdrawals, fees, and interest earned.

How to Access Your Bank Statement

Most banks offer multiple ways to access your bank statement. Here are some common methods:

Online Banking: Many banks have online banking platforms where you can view and download your bank statements. You will need to log in to your account using your username and password to access your statements.

Mobile Banking: If your bank has a mobile app, you can also view your bank statements on your phone. This is a convenient option for those who prefer to manage their finances on the go.

Paper Statements: Some banks still offer paper statements, which are usually mailed to your address at the end of each statement period. However, this option may come with a fee.

Why Is It Important to Review Your Bank Statement?

It is crucial to review your bank statement regularly to ensure that all the transactions listed are accurate. Here are some reasons why reviewing your bank statement is essential:

Detecting Fraud: By reviewing your bank statement, you can quickly identify any unauthorized transactions and report them to your bank. This can help prevent fraud and protect your account from unauthorized access.

Budgeting: Your bank statement provides a detailed record of your spending, making it easier to track your expenses and create a budget.

Identifying Errors: Sometimes, mistakes can happen, and transactions may be recorded incorrectly on your bank statement. By reviewing it, you can identify any errors and have them corrected by your bank.

Conclusion

NWEDI is simply a code used by banks to indicate that a deposit was made on a non-working day. It does not have any significant impact on your bank statement, and the deposited amount will still be reflected in your account balance. It is essential to review your bank statement regularly to ensure that all the transactions listed are accurate and to detect any potential fraud. With this knowledge, you can now confidently read and understand your bank statement, making it easier to manage your finances.