If you’ve recently checked your bank statement and noticed a charge labeled “PAI ISO,” you may be wondering what it means and why it’s on your statement. PAI ISO is a common charge that appears on bank statements and credit card statements, and it stands for “Payment Alliance International ISO.”

In this article, we’ll dive into what PAI ISO is, what it means for your bank account, and why it’s important to understand this charge.

Read to know OF London GB Charge on Bank Statement?

What is PAI ISO?

PAI ISO stands for Payment Alliance International ISO. Payment Alliance International (PAI) is a leading provider of ATM services, offering ATM processing, maintenance, and equipment to financial institutions and retailers. ISO, on the other hand, stands for Independent Sales Organization. An ISO is a company that a bank authorizes to sell its services, such as credit card processing, to merchants.

In simple terms, PAI ISO is a charge that appears on your bank statement when you use an ATM or make a purchase with your debit or credit card that Payment Alliance International processes through an Independent Sales Organization.

Why is PAI ISO on my bank statement?

PAI ISO appears on your bank statement when you use an ATM or make a purchase with your debit or credit card that Payment Alliance International processes. This means that the transaction was completed through an ATM or merchant that is affiliated with PAI and uses their services for processing payments.

PAI ISO charges can also appear on your statement if you use an ATM that is not affiliated with your bank. In this case, your bank may charge you a fee for using an out-of-network ATM, and this fee will be labeled as PAI ISO.

What does PAI ISO mean for my bank account?

If you see a PAI ISO charge on your bank statement, it means that you have used an ATM or made a purchase that Payment Alliance International processed. This charge will typically be accompanied by the name of the merchant or ATM where the transaction took place.

If you have used an out-of-network ATM, the PAI ISO charge may also include a fee from your bank for using an ATM that is not affiliated with them. This fee can vary depending on your bank’s policies and the type of account you have.

It’s important to note that PAI ISO charges are not fraudulent charges. They are legitimate charges that appear on your statement when you use an ATM or make a purchase that Payment Alliance International processes.

Why is it important to understand PAI ISO charges?

Understanding PAI ISO charges is important for a few reasons. First, it helps you keep track of your spending and understand where your money is going. By knowing what PAI ISO means and how it appears on your statement, you can easily identify transactions that Payment Alliance International processed.

Second, understanding PAI ISO charges can help you avoid unnecessary fees. If you know that your bank charges a fee for using out-of-network ATMs, you can only use ATMs that are affiliated with your bank to avoid these fees.

Lastly, understanding PAI ISO charges can help you identify any unauthorized transactions on your account. If you see a PAI ISO charge for a transaction that you did not make, it could be a sign of fraudulent activity on your account. In this case, it’s important to contact your bank immediately to report the unauthorized charge and take the necessary steps to protect your account.

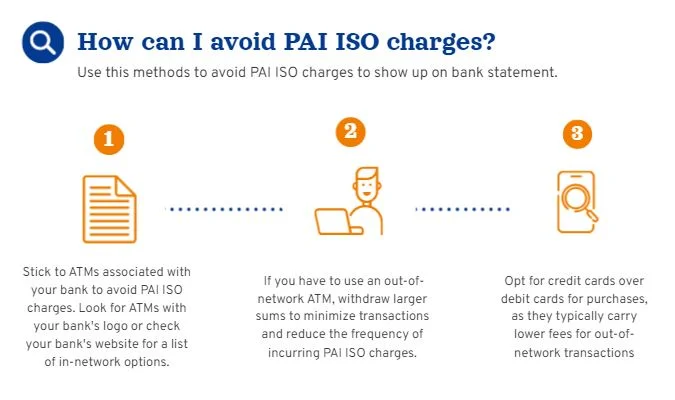

How can I avoid PAI ISO charges?

The best way to avoid PAI ISO charges is to use ATMs that are affiliated with your bank. This means using ATMs that have your bank’s logo or name on them. You can also check your bank’s website or mobile app to find a list of in-network ATMs near you.

If you need to use an out-of-network ATM, try to withdraw larger amounts of cash to minimize the number of times you need to use the ATM and incur fees. Consider using a credit card for purchases instead of a debit card, as credit cards typically have lower fees for out-of-network transactions.

Conclusion

In conclusion, PAI ISO is a charge that appears on your bank statement when you use an ATM or make a purchase that Payment Alliance International processes. Understanding this charge can help you keep track of your spending, avoid unnecessary fees, and identify any unauthorized transactions on your account. By using in-network ATMs and being aware of your bank’s policies, you can minimize the number of PAI ISO charges on your statement and manage your finances more effectively.