Buying a home is a significant financial milestone for many individuals, but it often requires a good credit score to secure favorable loan terms. You can’t get a mortgage or a good interest rate without first establishing your credit. It is essential to take proactive measures to raise your credit score if you want to purchase a house soon. This guide will outline five actionable steps you can take to improve your credit score and increase your chances of qualifying for a mortgage with favorable terms.

Step 1: Check Your Credit Report Regularly

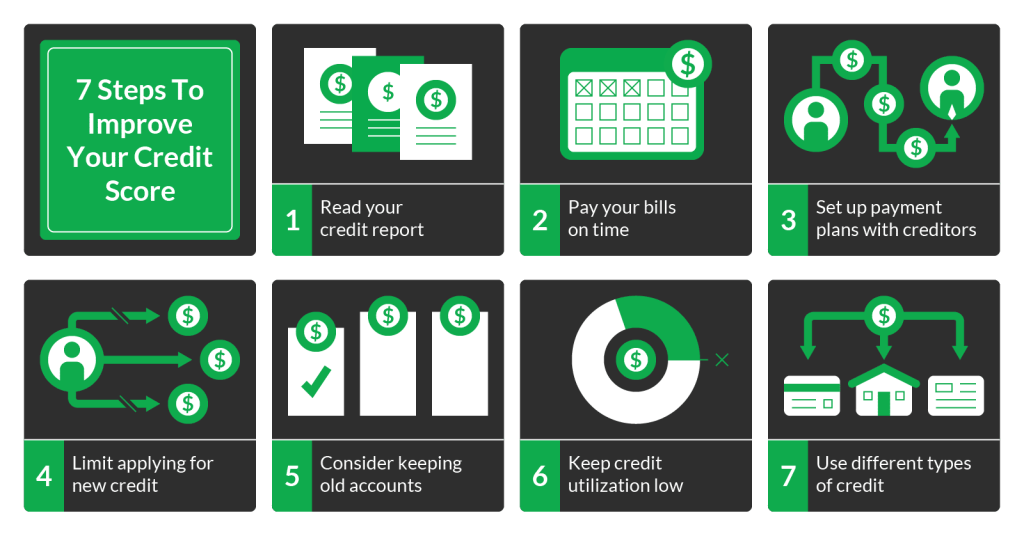

Getting a copy of your credit report from each of the three main credit bureaus—Equifax, Experian, and TransUnion—is the first step in improving your credit score. You can find out whether anything is wrong with your credit score by checking your credit report for mistakes and inconsistencies. Verify that there are no mistakes, such as erroneous account details, fraudulent actions, or old unfavorable reviews. Immediate correction of mistakes and improvement of your credit score may be achieved by disputing them with the relevant credit agency.

Step 2: Pay Your Bills on Time

One of the best strategies to raise your credit score is to be a consistent late payer. Your ability to repay loans on time shows lenders that you are a conscientious borrower as your payment history is a major factor in your credit score. You may avoid missing a payment deadline altogether by setting up automated payments or reminders. A good payment history in the future might assist lessen the effect of prior delinquencies on your credit score, even if you’ve made late payments in the past.

Step 3: Reduce Your Credit Card Balances

No matter how punctual your payments are, your credit score might still take a hit if your debt is too high in comparison to your available credit. Try to avoid carrying a debt that is more than 30% of your credit limit at all times. Reducing your credit card balances may have a positive effect on your credit usage ratio, an important component of your credit score. To gradually lower your outstanding bills and raise your credit score, you may want to think about making a repayment plan.

Step 4: Get Real Estate Dealer Help

Before buying a home, it’s essential to get real estate deal help to navigate the complexities of the process successfully. Consulting with professionals, such as a Telluride real estate agent or broker, can provide invaluable guidance and expertise. These experts can help you identify suitable properties, negotiate favorable terms, and navigate the intricacies of the buying process. Additionally, they can connect you with reputable lenders and financial advisors to help boost your credit score and secure favorable financing options. By leveraging their knowledge and experience, you can make informed decisions and maximize your chances of finding the perfect home in Telluride.

Step 5: Diversify Your Credit Mix

A favorable influence on your credit score can be achieved by having a variety of credit accounts, including mortgage loans, installment loans, and credit cards, among other types of loans . The ability to appropriately handle many forms of credit is a desirable trait for lenders to observe in borrowers. Consider the possibility of broadening your credit mix by creating a new form of credit account, such as a retail credit card or a modest installment loan, if you do not have a varied credit mix. However, you should only do so if you can manage the new account responsibly and keep from taking on more debt than you can repay.

Conclusion

In conclusion, boosting your credit score before buying a home is a crucial step in securing favorable mortgage terms and achieving your homeownership goals. By following the five steps outlined in this guide—checking your credit report regularly, paying your bills on time, reducing your credit card balances, getting real estate dealer help, and diversifying your credit mix—, you can improve your creditworthiness and increase your chances of qualifying for a mortgage with competitive interest rates. Taking proactive steps to boost your credit score can ultimately save you thousands of dollars over the life of your mortgage and pave the way for a smoother home-buying process.