If you’ve ever looked at your bank statement and noticed a transaction with the letter “SQ” next to it, you may be wondering what it means. At the same time, it may seem like a cryptic code, but “SQ” actually stands for Square, a popular payment processing company. In this article, we’ll dive into what Square is, how it works, and why you may see SQ on your bank statement.

Read to know about Unauthorized DoorDash Charges.

What is a Square?

Square is a financial services and digital payments company that was founded in 2009 by Jack Dorsey, the co-founder and CEO of Twitter. The company offers a variety of services, including point-of-sale systems, credit card processing, and online payment solutions. Square is known for its small, square-shaped card readers that attach to smartphones and tablets, allowing businesses to accept credit and debit card payments on the go.

How Does Square Work?

Square’s main product is its point-of-sale system, which includes a free app and a small card reader that attaches to a smartphone or tablet. This system allows businesses to accept credit and debit card payments from customers. When a customer makes a purchase, the business swipes their card through the reader or enters their card information into the app. The transaction is then processed through Square’s payment network, and the funds are deposited into the business’s bank account.

Square also offers online payment solutions for businesses that want to accept payments through their website or mobile app. This service allows customers to make purchases using their credit or debit card without having to swipe their card physically. Square charges a flat rate of 2.9% + $0.30 per transaction for online payments.

Why Do I See “SQ” on My Bank Statement?

If you’ve purchased from a business that uses Square as its payment processor, you may see “SQ” on your bank statement next to the transaction. This is simply an abbreviation for Square and indicates that the transaction was processed through their payment network. You may also see “SQ*” followed by the name of the business you purchased.

Is Square Safe?

One of the biggest concerns when it comes to online payments is security. Square takes security very seriously and has implemented several measures to protect both businesses and customers. All transactions are encrypted to protect sensitive information, and Square is PCI compliant, meaning they adhere to strict security standards set by the Payment Card Industry.

Square also offers fraud protection for businesses, which includes chargeback protection and dispute resolution services. This helps businesses avoid financial losses due to fraudulent transactions or customer disputes.

What Are the Benefits of Using SQ?

For businesses, using Square as their payment processor offers several benefits. First and foremost, it allows them to accept credit and debit card payments, which can increase sales and attract more customers. Square also offers a variety of tools and features to help businesses manage their finances, such as real-time sales data, inventory tracking, and customizable reports.

For customers, using Square means they can make purchases using their preferred payment method, whether it’s a credit or debit card. It also offers a convenient and secure way to make payments, especially for online purchases.

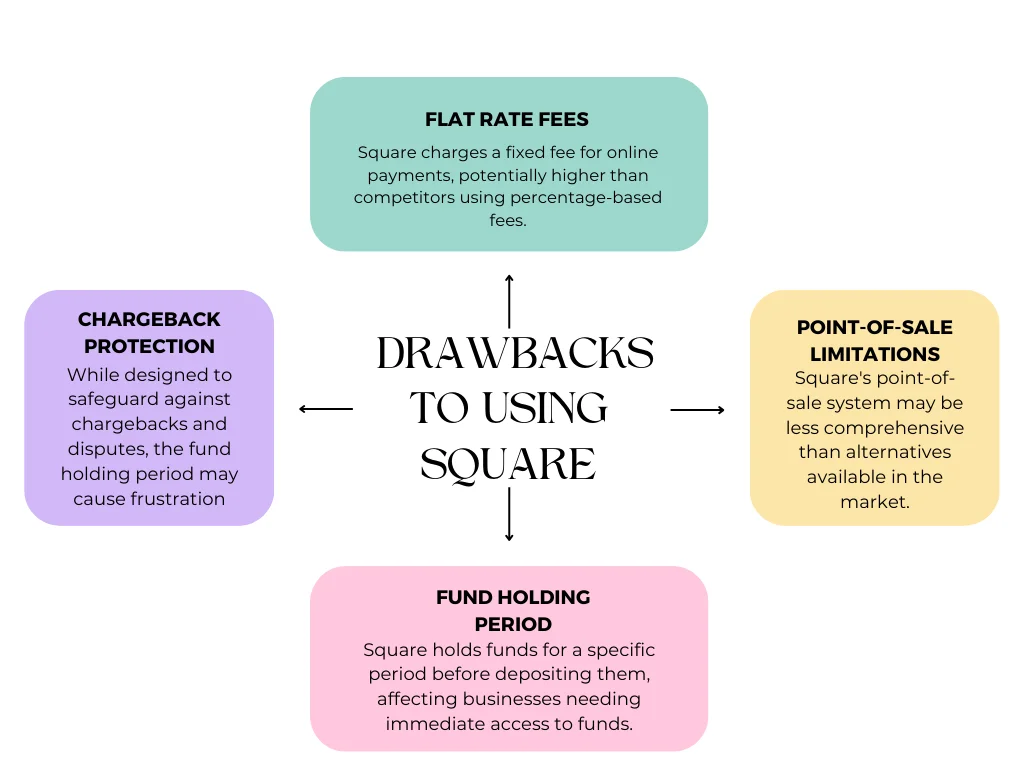

Are There Any Drawbacks to Using Square?

While Square offers many benefits, there are a few potential drawbacks to consider. One is the flat rate fee for online payments, which may be higher than other payment processors that charge a percentage of the transaction amount. Additionally, some businesses may find that Square’s point-of-sale system is not as robust as other options on the market.

Another potential issue is that Square holds funds for a certain period before depositing them into the business’s bank account. This is to protect against chargebacks and disputes, but it can be frustrating for businesses that rely on immediate access to funds.

What does SQ mean on a credit card statement?

“SQ” on a credit card statement typically refers to a Square transaction. Square is a mobile payment company that provides point-of-sale solutions, enabling businesses to accept card payments using a card reader attached to a mobile device. If you see “SQ” on your credit card statement, it indicates that a transaction was processed through Square.

Conclusion

“SQ” on a bank statement stands for Square, a popular payment processing company. Square offers a variety of services for businesses, including point-of-sale systems and online payment solutions. It is a safe and secure option for both businesses and customers and while it may have a few drawbacks, it remains a popular choice for many businesses. So the next time you see “SQ” on your bank statement, you’ll know that it’s just a transaction processed through Square’s payment network.